When a loved one passes away and their Last Will and Testament is entered into probate, the grieving family members sometimes know in advance who stands to inherit from the estate.

Parents, for example, generally share their estate planning directives and decisions with their children. Brothers and sisters are aware of arrangements, such as how the family real estate will be distributed (will it be sold, will it be passed down) as well as how the decedent’s personal property will be passed on — who gets the good china or the heirloom jewelry, for example.

It is when beneficiaries are surprised and shocked at the contents of a Last Will and Testament that things can get complicated. Sure, there are times when parents don’t share their plans with their offspring and like it or not, the parent’s decisions are steadfast in the probate court. However, there are also times when children are rightfully suspicious of a will and may be justified in believing that their parent has been the victim of undue influence.

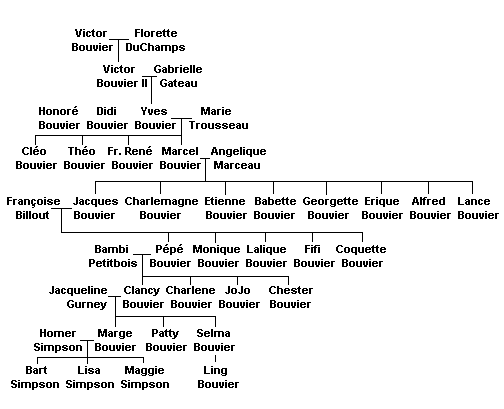

Marge Bouvier Simpson’s family tree

Elements of Proof for an Undue Influence Will Contest

Undue influence is a legal basis for tossing a will out of court and not allowing its provisions to control how the decedent’s estate is distributed. It is asserted in a legal proceeding in the probate court (a “will contest”) and the person challenging the will must provide sufficient evidence to prove that the challenged will is the result of undue influence upon the decedent by another person.

To prove undue influence, the will contestant must show two things:

(1) conduct over someone in the making of their will, which can include:

Over-persuasion

Duress

Force

Coercion; and/or

Artful contrivances; and

(2) the result of this conduct upon the testator, whereby:

Free agency and willpower of the testator has been destroyed; and

the resulting will is a product of the will of another, not that of the decedent.

Raimi v. Furlong, 702 So.2d 1273, 1287 (Fla. 3d DCA 1997).

When a Beneficiary Participates in The Drafting or Execution of the Last Will and Testament

One of the first circumstances that a Florida probate attorney should investigate when there is a suspicion that a person has exerted undue influence over a decedent is the actual drawing up and execution of the will documentation itself. Wills in Florida must be drawn up according to established probate laws; for example, there must be two witnesses to the signing of the will, and the signatures should be witnessed and sworn before a notary public.

If a will was drawn up at the request of the beneficiary who is inheriting most, if not all, of the property, this can be a hint to investigate further into the possibility of undue influence. That fact alone, however, is not enough to assert a claim of undue influence against a probated will. More evidence must be gathered regarding the above factors before a will contest based upon undue influence can be maintained.

The Case of The Grandmother’s Birthday Party Will

In Blades v. Ward, 475 So. 2d 935 (Fla. Dist. Ct. App. 1985), Lenora Johnson passed away and her granddaughter Yvonne filed her will for probate in the local Florida probate court. In the will, grandmother left everything to her granddaughter and she also named her as the personal representative of the estate. A will contest was quickly filed based upon undue influence by other family members who were not included in the will admitted to probate.

At trial, the contestants presented evidence that Grandmother Lenora was 90 years old, blind, with both of her legs amputated. She was frail, needing help to feed herself, to go to the bathroom, and to tend to other basic personal needs. She was also on medication for diabetes and a heart condition. All this, they argued, meant that she was vulnerable to being manipulated by the granddaughter.

As for the granddaughter’s involvement in the creation and execution of the will, evidence was presented (and undisputed) that Grandmother Lenora told her granddaughter in front of a notary public that “after expenses of my last illness, I want everything left to Yvonne Ward.” This was two months before the will was drawn up. The notary public was a friend of the granddaughter; the grandmother had just met her when this statement was made.

Several weeks later, the notary public presented a will document to Grandmother Lenora at her birthday party. While the party was going on (attended by family and friends), Grandmother Lenora signed the will without their knowledge and with only the notary and two witnesses in the room. The granddaughter had invited the notary to the birthday party; no one else knew her. One of the witnesses to the will was invited by the granddaughter, too; the other witness was the grandmother’s personal nurse.

Key factor here: at trial, the granddaughter did not present any evidence. Her strategy was to argue that her contesting family members had failed to prove their case and the will should stand as written. The probate judge agreed, and the contestants appealled. They won on appeal.

The reviewing court held that all this evidence created an “inference of active procurement of the will” using the Carpenter Factors (see our earlier post for a discussion of these legal factors). Five of these factors were considered to be present, and this meant that the contestants had done their job of proving up facts to raise a presumption of undue influence by the granddaughter over the grandmother.

However, that didn’t mean that the contestants won. It meant that Granddaughter Yvonne had the task of presenting evidence that the will was proper – that she didn’t exert undue influence over Grandmother Lenora.

Yvonne did not provide sufficient evidence at trial to give a “reasonable explanation” for her role in what happened. She did not rebut the presumption, which left the court with no choice but to rule in favor of the will contestants.

The Undue Influence Evidence Burden

In undue influence will contests, it is true that a person’s merely being involved in the execution of a will is not enough to establish undue influence. However, if other evidence can be provided along with a beneficiary’s control over the circumstances where a will is finalized and signed, then the court may presume there was undue influence and the beneficiary will need to prove they did not manipulate the decedent. It’s not enough to stand on the will, a defense will need to be made.

What would a successful defense involve? One example comes from the case of Derovanesian v. Derovanesian, 857 So.2d 240 (Fla. 3d DCA 2003), rev. denied, 868 So.2d 522 (Fla.2004), where the challenged beneficiary provided evidence that the will reflected the wishes of the decedent. Numerous reputable friends and colleagues of the elderly woman took the witness stand to support the disposition of the contested will as reflected the wishes of the decedent as she had explained them – away from and independent of the beneficiary who stood to inherit and who was being accused of undue influence.

Do You Suspect a Loved One Was the Victim of Undue Influence?

If you think that your family member or loved one may have been a victim of undue influence in the making of their Last Will and Testament, then you may have the burden of tracking down the evidence to prove your case. You will have to file an adversary proceeding to stop the will from being probated and the estate assets distributed, pending a ruling in probate court. These kinds of will contests can be complex; an experienced Florida probate lawyer can help you decide what your options are and what steps you need to take. Most probate lawyers, like Larry Tolchinsky, offer a free initial consultation to review your case and answer your questions.

If you have any questions about undue influence over a Florida Will, please do not hesitate to call us.

For more information check out our probate litigation page.

_______________

Do you have questions or comments? Then please feel free to send Larry an email or call him now at (954) 458-8655.

Do you have questions or comments? Then please feel free to send Larry an email or call him now at (954) 458-8655.

If you found this information helpful, please share this article and bookmark it for your future reference.